1. Get federal tax return forms and file by mail | USAGov

8 jan 2024 · Download them from IRS.gov · Order online and have them delivered by U.S. mail · Order by phone at 1-800-TAX-FORM (1-800-829-3676).

See where to get paper federal and state tax forms and instructions. Find the address to mail your paper tax forms depending on the form and where you live.

2. Federal tax forms | USAGov

Learn how to order tax forms by mail or get them online. Find out what to do if you do not get your W-2 form from your employer on time.

Find out how to get and where to mail paper federal and state tax forms. Learn what to do if you don't get your W-2 form from your employer or it's wrong.

3. Tax Forms - Ohio Department of Taxation

Need paper Individual or School District Income Tax forms mailed to you? Call the 24-hour form request line at 1-800-282-1782 to order Individual and School ...

4. IRS Tax Forms - Bankrate.com

12 dec 2017 · Get IRS tax forms and publications at Bankrate.com. Tax forms for individuals - 1040, 1040EZ, W-2. Tax forms for business - 940, ...

Get IRS tax forms and publications at Bankrate.com. Tax forms for individuals - 1040, 1040EZ, W-2. Tax forms for business - 940, Schedule C-EZ.

5. Income tax forms - Department of Taxation and Finance

24 nov 2023 · Here you can find commonly used income tax forms, instructions, and information for New York State full-year residents, nonresidents, ...

Here you can find commonly used income tax forms, instructions, and information for New York State full-year residents, nonresidents, or part-year residents.

6. Get tax form (1099/1042S) - SSA

Download a copy of your 1099 or 1042S tax form so you can report your Social Security income on your tax return.

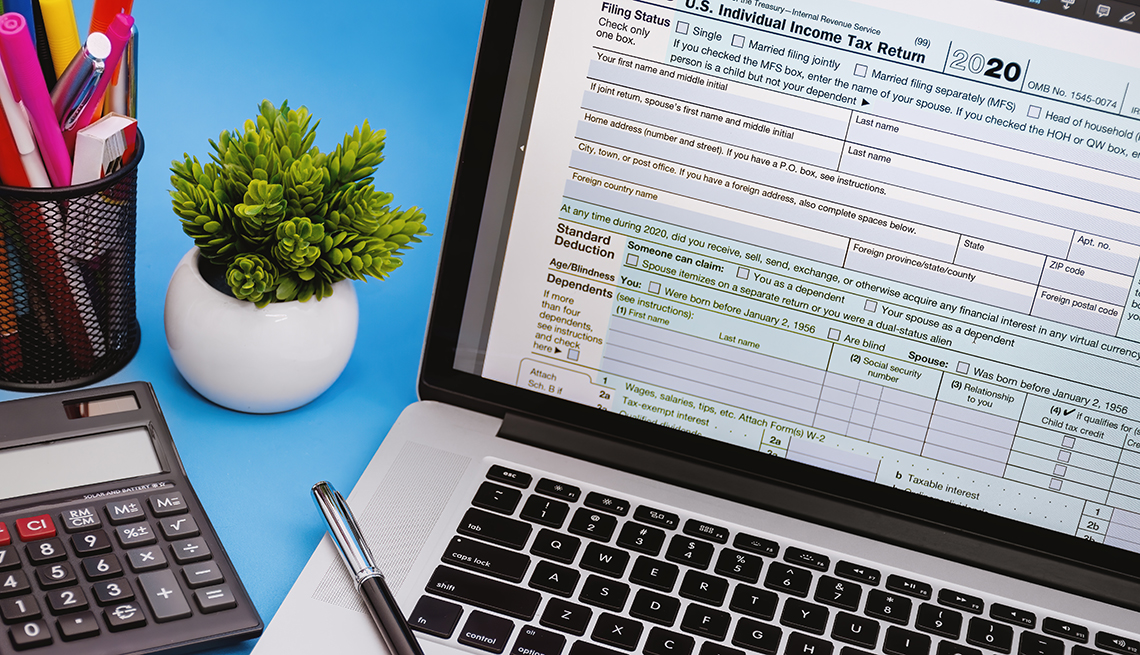

7. Where to Get Tax Forms - AARP

28 feb 2023 · The IRS no longer automatically mails out tax forms. The easiest way to get tax forms is through the IRS website. Learn more about finding ...

Consider e-filing instead for faster returns

8. Forms and Publications | FTB.ca.gov

24 jan 2024 · Your email information will not be collected and will be used solely for the purpose of providing requested forms. Other agency forms. IRS 20 ...

Forms

9. IRS Form W-2 Information - Deputy Commandant for Mission Support

These forms contain information members need to complete their individual federal income tax return. 3. In order for PPC to furnish the IRS Forms in a ...

We Processed (among other things) nearly 3,000 separations, 130,000 W2 and 1095 tax forms, 850 combat tax cases, closed 6,000 HEAT tickets

10. Request IRS Tax Return Transcript Online | Florida Atlantic University

If students or parents are not eligible to utilize the IRS Data Retrieval tool then copies of Tax Return Transcripts are needed in order for your verification ...

Downloading the IRS Tax Return Transcript

11. How to Request IRS Verification of Nonfiling Letter | Financial Aid Office

Online Request · Paper Request Form – IRS Form 4506-T (Request for Transcript of Tax Return) · How to fix address matching problems when ordering the Nonfiling ...

As part of the verification process for financial aid, the Department of Education requires that people who do not file taxes submit an IRS letter of nonfiling status to the University. A nonfiling letter will be necessary for all parties in the custodial household (i.e. student, parent 1, parent 2, spouse) that did not file taxes. What is […]

12. Offer in Compromise Pre-Qualifier - IRS

Forms & Pubs. Help & Resources. for Tax Pros. Electronic Federal Tax Payment System (EFTPS) · Debit or Credit Card · Check or Money Order · Understand Your IRS ...

Use this tool to see if you may be eligible for an offer in compromise (OIC). Enter your financial information and tax filing status to calculate a preliminary offer amount. We make our final decision based on your completed OIC application and our associated investigation. This tool should only be used as a guide. Although it may show you can full pay your liability, you may still file an offer in compromise and discuss your individual financial situation with the IRS.

13. Get your 1099-R tax form - OPM

We make the last 5 years available to you online. Click the save or print icon to download or print your tax form. How to request your 1099-R tax form by mail.

Welcome to opm.gov

14. Oregon Department of Revenue : Forms and publications

Order paper forms ... gov website) An official website of the State of Oregon ». Translate this ...

Find and download forms and publications, popular forms, Board of Property Tax Appeals (BOPTA), Cigarette and Tobacco, find current and search all forms. Order paper forms.

15. Request an IRS Wage and Income Transcript | University of North Texas

Click on the tax year needed under Wage and Income Transcript. Upload the document when prompted when submitting Verification online from MyUNT. Telephone ...

You can request an IRS Tax Return Transcript, free of charge, from the IRS in one of three ways:

16. IRS Tax Forms & Schedules Included in TurboTax Desktop

TurboTax Online: Important Details about Filing Form 1040 Returns with Limited Credits ... You must return this product using your license code or order number ...

List of forms and schedules included in TurboTax Desktop. Easily search to see which forms best fits your tax situation.

17. DOR: Tax Forms - IN.gov

Find federal tax forms (e.g. 1099, 1040) from the IRS. Individual ... Order Tax Forms Online · Other States' Tax Forms · Where to Mail Completed Tax ...

Find the proper forms for individual, corporate, and business taxes. Download forms, and navigate the tax landscape with ease and confidence.

18. 10 Key IRS Tax Forms, Schedules and Publications for 2024 - NerdWallet

29 mrt 2024 · File Form 4868 with the IRS by the April deadline — you can even do it online — and you'll buy yourself a tax extension until October. But ...

How to get a Form 1040, Schedule A, Schedule D or other popular IRS forms and tax publications for 2024, plus learn what the most common IRS forms are for.

19. IRS Tax Return Transcript Request Process - Oxnard College

Visit the IRS Web site at www.irs.gov; In the TOOLS section of the homepage ... Paper Request Form – IRS Form 4506T-EZ. IRS Form 4506T-EZ should be used ...